About the Alphabet

Many people perceive Alphabet as merely the parent company of Google, the world’s most recognized search engine. However, today it encompasses much more than that. The vision that the two founders, Larry Page and Sergey Brin, once dreamed of has now become a reality.

“Google is not a conventional company. We do not intend to become one.”

Alphabet is an online advertising platform that offers cloud-based solutions that connects individuals and companies around the world through applications and subscription services. The company’s core segments include Google Services, Google Cloud, and Google Bets. Under the Google Services umbrella, several brands are featured, such as the Android Operating System, Chrome, Google Search, Google Maps, Google Play, and YouTube. Google Cloud primarily provides cloud-based services for enterprise users. Additionally, Alphabet is active in various sectors through its subsidiaries, including Calico, Intrinsic, Verily, Waymo, and Wing, which are organized under the Google Bets segment. These companies are innovative and market leaders in their respective fields, including human health, robotics software, autonomous driving, and drone-based freight delivery.

Alphabet is also participating in the AI revolution. In 2023, the company made a significant advancement in making AI more accessible to everyone with the introduction of Gemini, a natively multimodal AI model. In 2024, the company launched Gemini 2.0. Gemini can generalize and seamlessly understand and combine different types of information, including text, code, audio, images, and video. Gemini powers AI features across Alphabet’s products and services, assisting people every day. Currently, Alphabet’s products—Android, Chrome, Gmail, Maps, Play Store, Search, and YouTube—are utilizing Gemini.

The management expects that the evolution of the digital economy will continue, which will be beneficial for the business in the long term. The biggest threat is intense competition. Therefore, Alphabet needs to focus on innovation and provide products and services that are valuable to users, customers, and partners. They must create a competitive and resilient business while protecting their financial condition and operational results.

To achieve a resilient position, Alphabet needs to increase its capital expenditures. Investing in technical infrastructure is crucial to support the growth of the business, particularly in artificial intelligence (AI) products and services. While rising capital expenditures may lead to a short-term decrease in net income, maintaining a high return on equity (ROE) could further enhance the growth rate.

The management plans to invest in new businesses, products, services, technologies, and systems, while also continuing to focus on acquisitions and strategic investments.

Financial overview

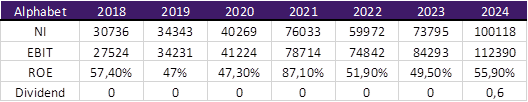

The company has steadily increased its net income, more than tripling since 2018. Correspondingly, its EBIT has more than quadrupled during this period, indicating a clear improvement in efficiency. Notably, this growth has occurred without a significant change in return on equity (ROE), with the average ROE in recent years—adjusted for the outperformance in 2021—remaining above 50%. The company does not pay dividends; instead, it reinvests all earnings back into operations. Maintaining this level of ROE is a sound management decision, representing genuine value creation for the company.

The debt-to-equity (D/E) ratio is stable, with a five-year variance of 1.77%. Therefore, we have chosen the Free Cash Flow to Equity (FCFE) discounted cash flow (DCF) valuation method to determine the intrinsic value of the company.

FCFE valuation

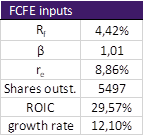

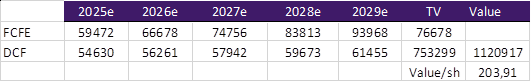

Using the 10-year U.S. Treasury bond as the risk-free rate, the expected return (Re) for equity holders is 8.86%. The average Return on Invested Capital (ROIC) over the past five years was 29.57%. Since the ROIC exceeds the Re, the company is considered a value creator. Taking into account the reinvestment requirements, the growth rate of Free Cash Flow to Equity (FCFE) is 12.1%, which is a substantial growth rate for a mature company.

Based on the Free Cash Flow to Equity (FCFE) valuation, the intrinsic value of the stock is $203.91, which is 18% higher than the current price of $172.73. This indicates that the company is slightly undervalued. With a 30% margin of safety, our target price is $142.74. However, since the current price exceeds this target, we do not recommend purchasing the stock at this time, as the upside potential is limited. We advise considering a buy if the price falls below $140.

Relative valuation

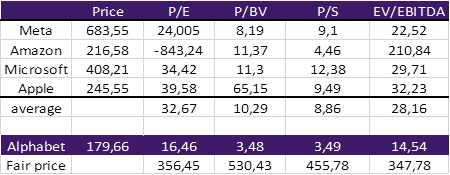

Over the past two years, the share price of Meta Platforms has increased by 301%, followed by Amazon at 131%, Alphabet at 101%, Apple at 67%, and Microsoft at 64%. While Meta Platforms’ share price has grown three times more than that of its competitors, it still justifies its valuation. In contrast, Amazon’s share price growth is not necessarily supported by its fundamentals, as both its P/E and EV/EBITDA ratios exceed the average. Now, let’s examine Alphabet’s valuation.

From a relative valuation perspective, the assessment is made in comparison to direct competitors. Extreme values have been excluded to prevent distortion in the calculation of averages; therefore, Amazon’s P/E ratio, Apple’s P/BV ratio, and Amazon’s EV/EBITDA ratio are not included.

These figures indicate that the average price-to-earnings (P/E) ratio of the competitors is 32.04, the average price-to-book value (P/BV) ratio is 10.13, the average price-to-sales (P/S) ratio is 8.7, and the average enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratio is 27.64. Alphabet has lower multiples across all metrics. If it were to reach the industry averages, its fair price would range from $340 to $522, with a median value of $414.9. Based on relative valuation, Alphabet is considerably undervalued in comparison to its peers.

Summary

The Alphabet stock was valued using the Free Cash Flow to Equity (FCFE) Discounted Cash Flow (DCF) method, which indicates that the stock is approximately fairly priced, with a share price of $172.73, while the estimated value per share is $203.91. This represents a slight undervaluation of 18%, but it is appropriately priced when considering the margin of safety. When comparing Alphabet’s share price to those of its competitors, we observe that Alphabet’s stock appears significantly undervalued; however, this is primarily due to the overvaluation of its competitors. These findings suggest that Alphabet is slightly undervalued relative to its intrinsic value, while its competitors are currently trading at inflated prices, resulting in Alphabet lagging behind its peers. At the current price level, we recommend holding the shares, with a buy recommendation for prices below $140.