Part 2

In the first half of this article we looked at the state of the Chinese and US economies and saw that for decades the situation where China produces and America consumes has been favourable for both countries, with free trade and globalism creating a win-win situation.

But the situation has slowly changed because the US debt has reached unsustainable levels.

The reasons for the dollar’s strengthening

Let’s look at the reasons for the steady and slow rise of the dollar.

a, The US has dominated the world economy since World War II and as the most economically advanced country, everyone has traded with it, so demand for the dollar has been constant.

b, Since commodities are also denominated in dollars, trade between countries is also dollar-based, creating a gradual demand for greenbacks.

c, The strength of the dollar has been supported by the fact that the world economy has grown at an average annual rate of 2-3% over the last 20-25 years, and this constant demand pressure has created a constant demand for dollars in dollar-based trade.

d, As Chinese companies sold their products in the US, which earned them dollars, a lot of dollars flowed into China, which also had to be invested.

Companies used their dollars to buy US government bonds. The Chinese government also invested the surplus dollars from foreign trade to US government bonds, which helped price stability, and for political reasons they thought it would be good for them to become the biggest financier of the US, in case it would come in handy for them…

The factors that contributed to the strengthening of the dollar meant that the US had to artificially weaken the dollar. This put the US in an extremely comfortable position: it could print about $1,000 billion a year due to the decades of dollar appreciation without this being reflected in the weakening of the dollar, because the dollar strengthening effects absorbed this excess paper money. This nearly $1000 billion a year was spent on health care, social assistance, arming the military, etc., so it is certainly not true that the US was the victim of this existing system! It is a different question whether the purpose for which this money was spent was appropriate or why it was not prepared in time in case the situation should change.

The problem that Trump wants to solve

Overall, the real problem is that the growth of the US public debt is unsustainable even in the medium term. This needs to be addressed, as GDP based on consumption can no longer grow at a rate that would allow the debt to be paid down.

The time for printing money to solve the crisis is over, as this would only put the debt on an even more unsustainable path.

Many experts are calling for the classic solution: inflate the debt. That’s why Trump is pushing Fed Chairman Jerome Powell to lower interest rates.

If he cuts rates, inflation will run out of control and the dollar will weaken. Once real interest rates start to fall, the question is: will foreign investors continue to buy US Treasuries? Because if lower real interest rates are no longer as attractive, who will finance the public debt?

Donald Trump’s plan

Trump believes that this situation was caused by other countries, others profiteered at the expense of the US, which is partly true. However, he forgets to add that the US population has benefited from this system as much as the government that has been able to maintain its welfare measures. He expects other nations to pay the financial costs of this situation, because the US has been exploited, it has been screwed for decades, it is time to pay the bill and finally level the playing field.

Impose tariffs, making US imports more expensive. Consumption falls as a result of rising prices, the duties are paid by the importer, and a significant part of the price increase goes to the budget in the form of tariffs. This could form the basis for a possible tax cut, which would push consumption back to its initial level. That’s why, he said repeatedly, the process will be painful at first, but will eventually succeed. And if, on top of that, it is possible to lure factories from China, it could boost GDP further, solving the problem without a major economic downturn.

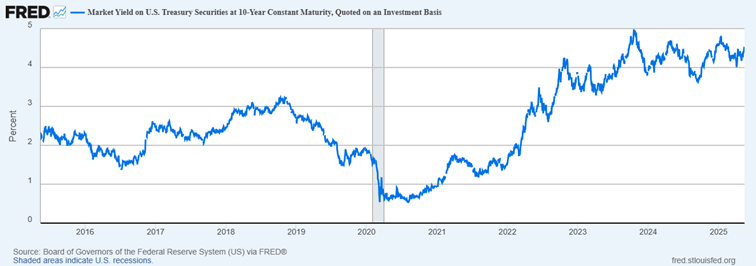

However, two things the Trump administration certainly did not expect: first, the unrealistic tariff threat against everyone caused a crisis of confidence, so not only did the stock market fall significantly, but we also saw a complete turnaround in the bond market as well, with the 10-year interest rate above 5%.

On the other hand, China’s announcement that it would consider selling its US government bonds caused turbulence in the bond market, which in turn pushed interest rates well above the 5% psychological threshold…

This has led to a complete backlash from the US administration. First it suspended all tariffs for 90 days, then it entered into intense negotiations with its trading partners, and finally, on 11 May, it came to the negotiating table with China and reached an agreement.

In my view, this is clearly a failure for Trump and a victory for Xi. It has shown that the US is vulnerable, it is not the player it used to be or as many people thought. Its vulnerability is caused by its sovereign debt, at the end of which stands China, the main holder of sovereign debt. I wouldn’t be surprised if Trump soon backtracks on these tariffs, because he has to admit: he can’t solve the problem with tariffs, and his trading partners won’t foot the bill.

The solution

I think Trump will soon realise that the solution to the public debt problem is domestic, the tariffs will not solve the problems.

The Fed’s dual mandate is to create price stability with a sustained low level of unemployment.

The overwhelming majority of economic advisors argue that the debt should be inflated, as it has been for years and decades. They are therefore calling for a cut in interest rates, which would cause inflation to spike again as the dollar weakens.

If the dollar weakens and inflation is high, real interest rates will fall, the government bond market will become less attractive, and if foreign buyers turn away from buying government bonds, interest rates will rise. This will again lead to financing difficulties. That is why they say: it is not important what the base rate is, but what the 10-year bond yield is.

In addition, a cut in interest rates would lead to a further increase in consumption and a reduction in investment and savings, which would not solve the problem, but exacerbate it.

Level of unemployment bottomed around 6 million in 2023. Since then, it has been slowly but steadily rising, with 7.2 million people currently unemployed in the US, an unemployment rate of 4.2%. Keeping interest rates high, or even raising them in order to increase savings and reduce consumption, will make it harder for companies to get credit, and unemployment will rise.

So it seems very likely that lowering interest rates would lead to debt financing problems and raising interest rates would lead to unemployment. It is not difficult to see that both outcomes will lead to an economic crisis. The question is which of the two evils is chosen.

In my opinion, the second solution will come about: while keeping interest rates relatively high, the population and companies will be pushed towards savings, even by administrative means. This will create additional demand for government bonds, which will cause their yields to fall, make subsequent refinancing cheaper, and allow debt to be managed. The price of this will be lower consumption and lower business investments, leading to higher unemployment, which will further depress consumption. The fall in consumption will lead to a fall in GDP and a recession, which will lead to a further fall in consumption and a further rise in savings. This could be a long process lasting several years, bringing debt to manageability and normalisation. In this case, however, the dollar will strengthen rather than weaken, so that it can retain its function as the world currency and the US can remain the largest economic power in the long term.

Conclusion

President Donald Trump is exerting considerable pressure on the Fed to cut interest rates in order to weaken the dollar. A weaker dollar is aimed at improving the export capabilities of US firms. This, the President believes, will lead to a new prosperity for the US.

But a weaker dollar reduces the real returns for foreign sovereign investors, which can easily turn them away from the US government bond market, as we saw in late May with the failed 20-year bond issue, when there was insufficient demand for the amount to be issued. If, in addition, this is coupled with the sale of bonds, the interest rate on bonds will rise significantly, refinancing government debt at higher interest rates, making the system unsustainable through a spiral effect. This is why the Fed is reluctant to cut interest rates, even though it has ample scope to do so given the low level of inflation.

Another possibility is that, in addition to lowering the base rate, the Fed could lower government bond yields by direct purchases, but this can only be done by borrowing more money, so the intervention could be successful, but in the longer term it will actually increase government debt.

The idea was to get additional revenue from other countries in the form of tariffs. However, it seems that nobody really wants to participate in this. China is playing for time, so the EU is the next victim. Tariffs are also being suspended with them, and these efforts are starting to be taken seriously. And time is working against the US. So in fact Trump has to find a solution to this financial problem urgently.

Since the situation is indeed a stalemate, there seems to be only one solution: to resolve the situation domestically, with the involvement of the US population. This will lead to a fall in consumption and ultimately to a recession. In my opinion, within a few months, everyone will realise that there is no other way.