Bartimaeus, the blind beggar (Mark 10,46-52) is sitting beside the road begging,

outside the gates of Jericho. He can not benefit from the wealth of the town

because he can't see. When passing by him, Jesus asks him: „What do you want me

to do for you?” „My rabbi” replies the beggar „ I want to see”.

You are also as blind as Bartimaeus when investing at random instead of

following any strategy. Sometimes, you take huge risks by being too confident or

the opposite, your fears guide you. You may feel the need to find an objective

point of view based on careful calculations.

Our company, Bartimaeus Capital Investment Ltd. helps you to reach your

investment goals. With our expertise you will able to distinguish valuable things

from unvaluable ones you will have an overall view of investment opportunities and

the possibility to choose among them.

People who have inspired our investment visions the most:

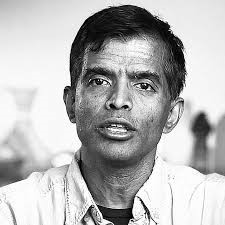

Benjamin Graham (1894-1976)

Known as the 'father of value investing', he was a professor at Columbia

University. He considered that the value of investment differs from its price and

these two converge over time.

He summarized his principles in his main work, The intelligent investor,

published in 1934. He had a stong influence on his former student,

Warren Buffet who followed this investment philosophy to rebuild his company,

Berkshire Hathaway Inc.

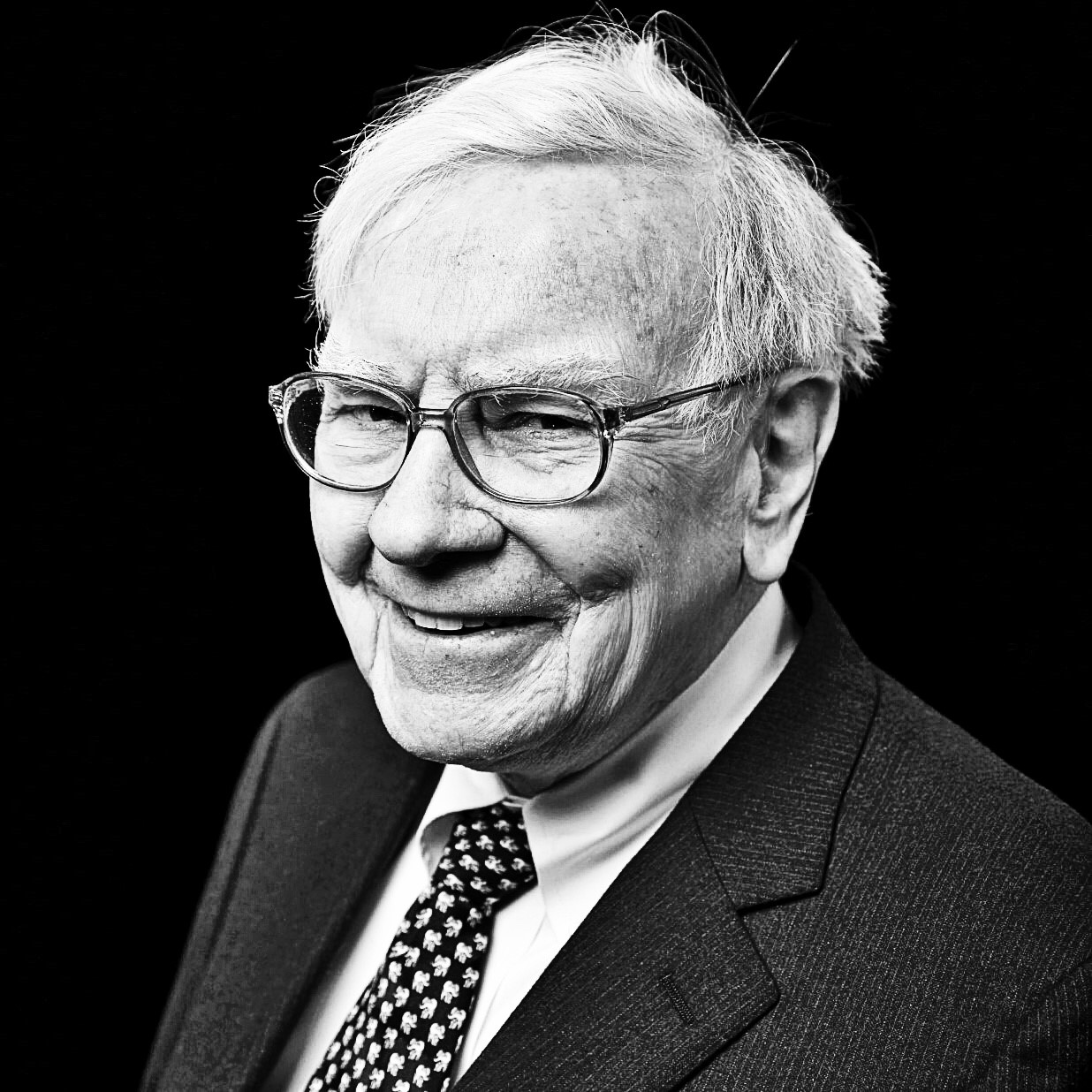

Warren E. Buffett (1930-)

The most famous investor of the value investing, the Oracle of Omaha, the owner and CEO of

Berkshire Hathaway. His wealth grew by 20,1% per annum in the last 35 years, so he is the

best investor ever.

The most successful investor of our age, lots of books, films based on his story.