At Bartemaeus Capital Ltd. we strongly believe that all investments have an intrinsic value and it is independent from trading market price.

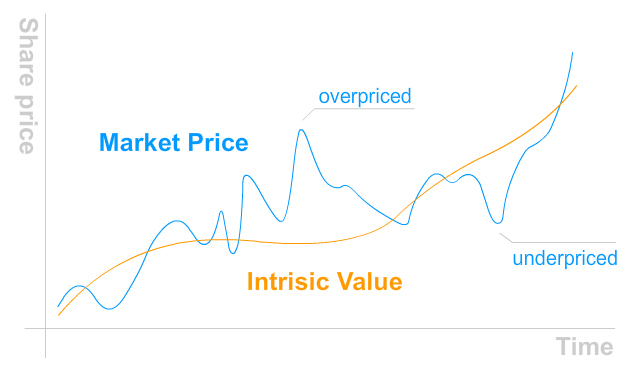

According to our strategy, markets are inefficient therefore investment products are not properly priced; their value and their price do not match. They may be over- or underpriced. In order to assess their real value, we can provide a profound analysis.

Regarding that market analysts have a limited knowledge, they are working with different biases. We have reservations about their results, hence we use margin of safety. This is usually the 33% of the result. This margin of safety provides us to be more consenvative in our calculations.

From the financial reports of the company we assess its return on capital and cost of capital. After that we do an estimate of the reinvestment need of the company and calculate its future results in the coming years.

We do not reccommend highly leverage companies in order to avoid risky investments.

Using the above values, we calculate the owner earnings for the coming years. These results will be discounted with the cost of capital to assess the intrinsic value of the company.

An important part of the analysis is to assess the real value of the company compared to its concurrents and its own previous performance. This process may sound simple, however it is rather complicate as the calculation is based on estimations. We consider that prices of stocks converge to their intrinsic values over time but you need patience and perseverance for this kind of analysis.